Mileage Tracker Can Be Fun For Anyone

Table of ContentsExcitement About Mileage TrackerHow Mileage Tracker can Save You Time, Stress, and Money.How Mileage Tracker can Save You Time, Stress, and Money.The 45-Second Trick For Mileage TrackerMileage Tracker Can Be Fun For AnyoneThe Single Strategy To Use For Mileage Tracker

In order to realize the benefits of GPS gas mileage logs without driving workers out the door, it's vital to select a proper general practitioner application and institute guidelines for ideal use. Vehicle drivers ought to have the ability to edit trips and designate certain sections as individual to ensure that no data concerning these journeys will be sent to the company.

It is typical for the majority of companies to check staff members' use of the internet on company tools. The simple truth of checking prevents unproductive net usage without any type of micromanagement.

Facts About Mileage Tracker Revealed

As an example, organizations in the transportation and shipment field often need to keep accurate mileage documents to comply with industry guidelines. mileage tracker. Maintaining an accurate gas mileage log can work as an audit path in instance of an IRS audit or other compliance-related queries. Having a reliable record of your mileage can aid substantiate your insurance claims and stay clear of potential penalties

We will certainly provide suggestions on just how to organize your gas mileage records well. We'll also explain how to abide by storing your gas mileage logs securely, and address usual questions and concerns regarding gas mileage log layouts.

When you track your miles effectively, you'll have a clear record of just how much you drove for company. This makes it simple to determine your tax deductions without having to guess or clamber for information later on. Having an arranged log also lowers the threat of mistakes on your tax obligation return, which might conserve you from potential fines.

Consistency is vital to an excellent gas mileage log. It reduces the chance of missing out on journeys or information. Make use of these strategies. They will help you maintain your mileage records arranged. This will certainly conserve you effort and time over time. We designed our template to be user-friendly, even for those that are not tech-savvy.

3 Simple Techniques For Mileage Tracker

Compare it with the supporting papers to find any distinctions. By adhering to these suggestions, you can keep accurate mileage records and be planned for the internal revenue service or any type of other pertinent analysis. An arranged gas mileage log has even more benefits. For example, a comprehensive document of your organization journeys can help you assess your driving.

This can result in cost savings in terms of gas consumption and automobile maintenance. An exact mileage log can help track and record service you could check here expenses. By connecting each trip to its objective, you can conveniently find the proportion of mileage pertaining to your service. This info is essential for getting reimbursements or claiming deductions.

The Mileage Tracker Statements

Gas mileage monitoring apps are excellent tools for decreasing mileage overestimation and error. General practitioner monitoring captures exact information that managers can oversee and approve. While mileage scams is rare, it occurs; mistakes, nevertheless, prevail, and firms need smart systems to make certain that these errors are gotten rid of. If you are running an IRS-compliant program without a mileage tracker, it is still not likely that deceitful mileage cases are prevalent.

If the odometer readings do not match the reported traveling distances, HR can conveniently identify the discrepancy. In addition, at Cardata, we have dealt with 10s of hundreds of sales reps, distributors, and all manner of employees that drive for job, and we have actually found that they all have something alike: they are truthful individuals.

A driver could, for instance, drive their personal vehicle on the weekend break, bringing the odometer up, and afterwards report that drive as part of a service journey that they handled Monday. This is an her response unusual event, yet it is possible, so HR leaders should understand it. Without a general practitioner reading of where the car took a trip, it would certainly be impossible to validate whether the mileage entry was accurate or exaggerated.

5 Easy Facts About Mileage Tracker Explained

When staff members track their organization miles with a gas mileage tracking application, their records end up being extra exact. GPS applications can capture gas mileage with remarkable accuracy: the ideal hardware and software application can pinpoint places within meters. An administrator site is desktop or internet browser software application that allows administrators see the gas mileage their group is reporting via the app.

As I discussed, with a mileage tracker there is very little possibility of any kind of mileage being missed, so drivers get repaid for every mile. An also greater benefit is that they do not have to throw away time on hand-operated mileage logs.

That is a substantial time dedication. Gas mileage trackers give vehicle drivers their time back. Whatever required to justify mileage in accordance with your firm driving policy, or perhaps to important link the IRS, is captured and saved by a gas mileage capture application. More reading: Save vehicle drivers a week of work per year with a mileage tracker. Seek an app that has exact tracking, to start with.

An Unbiased View of Mileage Tracker

Due to the fact that despite having the very best software program there are occasionally errors in general practitioner mileage capture, make certain the application you get is backed by a strong consumer assistance team. Business human resources leaders require experts that they can call when it is time to repair. Ensure the app is coupled with an administrator website that program supervisors can utilize to look after gas mileage.

Josh Saviano Then & Now!

Josh Saviano Then & Now! Danny Pintauro Then & Now!

Danny Pintauro Then & Now! Talia Balsam Then & Now!

Talia Balsam Then & Now! Tina Louise Then & Now!

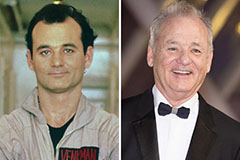

Tina Louise Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now!